California Low Cost Auto Insurance Program

With rates on the rise in California, more drivers are having a hard time paying their auto insurance premiums. The good news is there are options like the California Low Cost Insurance Program designed for low-income drivers.

This important program helps qualified drivers get much cheaper rates than standard market rates while meeting the state’s legal insurance requirements.

The California Low-Cost Auto Insurance Program offers affordable liability coverage for eligible drivers.

The California Low-Cost Auto Insurance Program Offers Liability Insurance coverage

The CLCA is a state-sponsored initiative that offers affordable liability insurance to income-eligible drivers in California. The program was created to help reduce the number of uninsured motorists on the road while ensuring low-income individuals have access to legal and financial protection in case they get into an accident.

Knowing when to buy LA liability car insurance is crucial. Here are some key situations when you need to get your automobile covered.

How to Qualify For California Low Income Car Insurance

To be eligible for the California Low-Cost Auto Insurance Program, applicants must meet the following requirements:

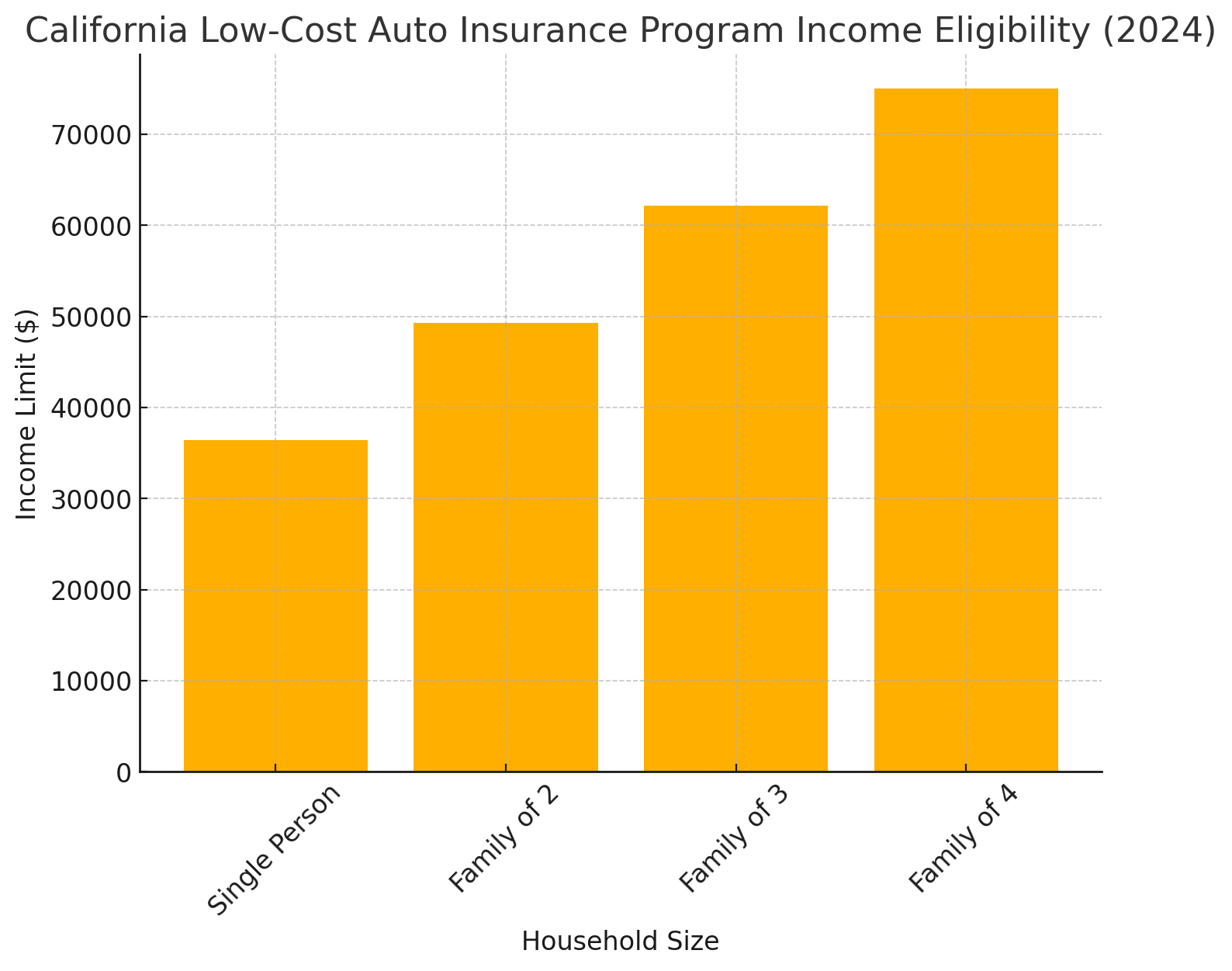

Income Requirements:

Your household income must be at or below 250% of the federal poverty level (FPL).

For example, as of 2024, the income limits are approximately:

- $36,450 for a single person

- $49,300 for a family of two

- $62,150 for a family of three

- $75,000 for a family of four

Higher limits apply to larger households.

Vehicle Requirements:

- The insured vehicle must have a current market value of $25,000 or less.

- The vehicle must be registered in California.

Driver Requirements:

- The applicant must have a valid California driver’s license.

- The applicant must be at least 16 years old.

- All licensed drivers in the household must be covered by the policy.

Good Driving Record:

- No at-fault accidents involving bodily injury within the past three years.

- No more than one point on the driving record within the past three years.

- What Does the CLCA Insurance Cover?

The California Low-Cost Auto Insurance Program provides basic liability coverage that meets the state’s minimum legal requirements.

California Low Cost Auto Insurance Coverage

- Bodily Injury Liability:

- $10,000 per person

- $20,000 per accident

Property Damage Liability:

- $3,000 per accident

- Optional Add-Ons:

- Medical payments coverage (for an additional cost)

- Uninsured motorist bodily injury coverage (for an additional cost)

Higher limits apply to larger households.

Vehicle Requirements:

- The insured vehicle must have a current market value of $25,000 or less.

- The vehicle must be registered in California

Driver Requirements:

- The applicant must have a valid California driver’s license.

- The applicant must be at least 16 years old.

- All licensed drivers in the household must be covered by the policy.

Good Driving Record:

- No at-fault accidents involving bodily injury within the past three years.

- No more than one point on the driving record within the past three years.

- What Does the CLCA Insurance Cover?

The California Low-Cost Auto Insurance Program provides basic liability coverage that meets the state’s minimum legal requirements

California Low Cost Auto Insurance Coverage

- Bodily Injury Liability:

- $10,000 per person

- $20,000 per accident

Property Damage Liability:

- $3,000 per accident

- Optional Add-Ons:

- Medical payments coverage (for an additional cost)

- Uninsured motorist bodily injury coverage (for an additional cost)

Pros And Cons of The California Low Cost Auto Insurance Program

Pros:

✔ Affordable Rates – Premiums start as low as $244 per year, though costs vary by county and driver profile.

✔ Legal Compliance – Helps low-income drivers meet California’s minimum liability insurance requirements.

✔ State-sponsored – Ensures transparency and reliability, as it is regulated by the California Department of Insurance.

✔ Available Statewide – Every county in California offers CLCA coverage.

✔ Good for Safe Drivers – The program encourages and benefits low-risk drivers with clean records.

Cons:

✖ Limited Coverage – CLCA only covers liability, meaning no coverage for your vehicle if you cause an accident.

✖ Strict Eligibility Criteria – Many drivers won’t qualify if their income is slightly above the threshold or their car is worth over $25,000.

✖ Not Available for High-Risk Drivers – If you have multiple traffic violations or accidents, you cannot qualify.

✖ Lower Property Damage Limit – The $3,000 property damage liability limit is lower than California’s general minimum of $5,000.

Applicants must provide:

✔ Proof of income (e.g., tax returns, pay stubs, Social Security benefits letter)

✔ California driver’s license

✔ Vehicle registration documents

✔ Driving history details

Best Insurance Companies for Low-Income Drivers in LA

If you don’t qualify for the California Low Income car insurance program there are still options you can explore. Here are some of the cheapest insurers in the LA area.

- 1. GEICO

GEICO is a popular choice for budget-conscious drivers due to its consistently low rates and extensive discount programs.

Why GEICO? Offers some of the most affordable rates for minimum coverage policies.

Provides a variety of discounts, including good driver and defensive driving discounts.

Offers a user-friendly mobile app for policy management. Geico has very strong financial backing and positive customer service reviews.

Discounts Available:

Good driver discount (up to 22%)

Defensive driving course discount

Multi-policy discount (bundling auto and renters insurance)

Low-mileage discount

Vehicle safety feature discount

- State Farm

State Farm is another excellent choice for low-income drivers looking for reliable and affordable car insurance.

Why State Farm? Competitive rates for both minimum and full coverage policies. Provides numerous discount opportunities. Offers personalized service through a network of local agents.

Has flexible payment plans to accommodate different budgets.

Discounts Available:

Safe driver discount (up to 30%)

Low-mileage discount

Good student discount (for young drivers)

Multi-policy discount

Drive Safe & Save telematics program

- Mercury Insurance

Mercury Insurance is well-known in California for offering affordable auto insurance tailored to budget-conscious drivers.

Why Mercury?

Consistently offers lower rates compared to other major insurers. Specializes in high-risk driver coverage, which can be beneficial for those with a less-than-perfect driving record.

Offers a variety of discounts to lower costs further.

Multi-car discount

Anti-theft device discount

Good driver discount

Professional affiliation discount

Pay-in-full discount

How to Get Multiple LA Car Insurance Discounts

If you are a low-income driver in Los Angeles, maximizing your discounts can help lower your premium significantly. Here are several ways to save:

- Maintain a Clean Driving Record

One of the best ways to qualify for discounts is by maintaining a clean driving record. Most insurance companies offer good driver discounts, which can reduce your premium by up to 30%. Avoiding accidents, tickets, and DUIs will help you maintain lower rates over time.

- Take a Defensive Driving Course

Many insurers offer discounts if you complete a state-approved defensive driving course. This can save you around 5-10% on your premium. Defensive driving courses teach safe driving techniques that help reduce the likelihood of accidents.

- Opt for a Higher Deductible

If you can afford a higher deductible, you can significantly lower your monthly premium. However, make sure you have enough savings to cover the deductible in case of an accident.

- Bundle Your Policies

If you have renters or homeowners insurance, bundling it with your car insurance can help you secure a multi-policy discount. Many insurers provide savings of up to 25% for bundling multiple policies.

- Take Advantage of Low-Mileage Discounts

Drivers who travel fewer miles annually are considered lower risk and may qualify for a low-mileage discount. If you drive less than 7,500 miles per year, you may be eligible for additional savings.

- Install Safety and Anti-Theft Devices

Cars equipped with safety features like anti-lock brakes, airbags, and anti-theft devices are less risky to insure. Many insurers offer discounts for vehicles with these safety features.

- Use Pay-Per-Mile Insurance

If you drive infrequently, a pay-per-mile insurance policy could be a more cost-effective option. Companies like Metromile offer plans where you only pay for the miles you drive, which can be beneficial for low-mileage drivers.

- Shop Around and Compare Quotes

Insurance rates vary between providers, so it’s essential to compare multiple quotes before selecting a policy. Online comparison tools can help you find the best rates for your situation.

The Final Word On LA Insurance For Low Income Drivers

Finding cheap LA Insurance for low income drivers is available for those who meet the requirements. The California Low-Cost Auto Insurance Program (CLCA) is an excellent option for low-income residents who need affordable auto insurance to comply with state laws.

While it offers basic liability coverage at a lower cost, it does come with coverage limitations that may not be ideal for every driver. If you qualify, this program provides a legal and budget-friendly way to stay insured in California. Apply for a free LA auto insurance quote online in less than five minutes. Save more money today on the insurance you need.